Quicken Classic Deluxe Review: Is It Worth Your Money?

Key Takeaways

- This comprehensive review will cover the features and benefits of Quicken Classic Deluxe

- We'll explore how this personal finance software can help you manage your finances effectively

- You'll learn how to use Quicken Classic Deluxe to achieve your financial goals

Are you tired of living paycheck to paycheck, wondering where all your money is going, and struggling to make ends meet? You're not alone. Many of us struggle to manage our finances effectively, leading to financial stress and anxiety. But what if you could take control of your finances and start building a secure financial future?

About Quicken Classic Deluxe

Quicken Classic Deluxe is a comprehensive personal finance software designed to help you take control of your finances and achieve your financial goals. With its user-friendly interface and robust features, this software is perfect for individuals and families looking to manage their finances effectively.

| Feature | Description |

|---|---|

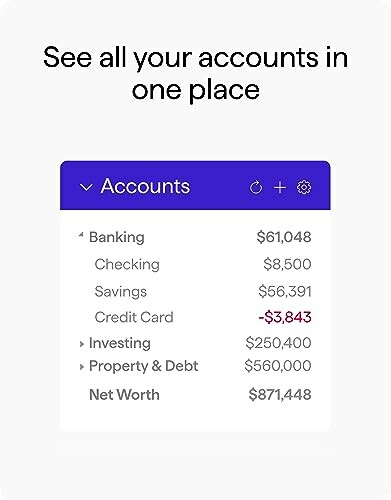

| Connect Banking, Credit Cards, Debt, Investments & Property | Quicken Classic Deluxe allows you to connect all your financial accounts, including banking, credit cards, debt, investments, and property, in one place, giving you a clear picture of your financial situation. |

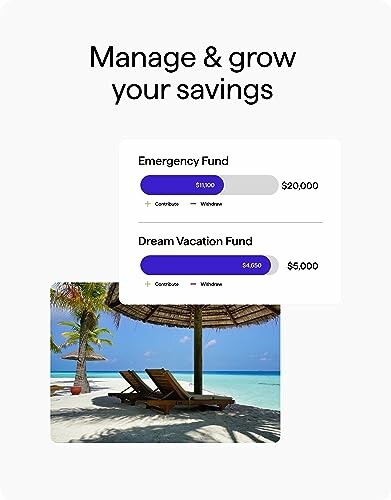

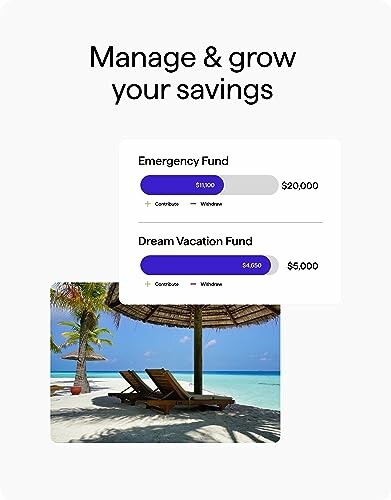

| Manage & Grow Your Savings | This software provides tools to help you manage and grow your savings, including budgeting, tracking spending, and setting financial goals. |

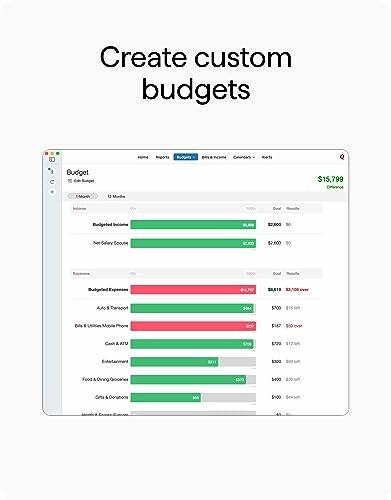

| Create Custom Budgets & Track Spending | With Quicken Classic Deluxe, you can create custom budgets and track your spending to stay on top of your finances and make informed financial decisions. |

| Project Different Debt Scenarios | This software allows you to project different debt scenarios, helping you make informed decisions about managing your debt and achieving financial freedom. |

This comprehensive software is designed to provide you with a clear picture of your financial situation, helping you make informed decisions about your money.

- This software is perfect for individuals and families looking to manage their finances effectively.

- With Quicken Classic Deluxe, you can take control of your finances and start building a secure financial future.

- This software is designed to be user-friendly, making it easy to get started and start achieving your financial goals.

Whether you're looking to pay off debt, build an emergency fund, or save for a big purchase, Quicken Classic Deluxe has the tools and features you need to succeed.

Check Current Price

Check Current Price

Quicken Classic Deluxe: Weighing the Pros and Cons

Pros

- User-friendly interface makes it easy to get started and navigate

- Connects to multiple financial accounts, including banking, credit cards, debt, investments, and property

- Provides tools to manage and grow savings, including budgeting, tracking spending, and setting financial goals

- Custom budget creation and tracking allow for personalized financial planning

- Project different debt scenarios to make informed decisions about managing debt

Cons

- Some users may find the software's features and functionality overwhelming

- Limited reporting capabilities may make it difficult to generate specific reports

- May require some technical knowledge to set up and customize

In conclusion, while Quicken Classic Deluxe may have some drawbacks, its numerous benefits and features make it a valuable tool for anyone looking to take control of their finances. With its user-friendly interface, comprehensive financial tracking, and customizable budgeting options, this software is well worth considering for anyone seeking to achieve financial stability and security.

Seize Control of Your Finances with Quicken Classic Deluxe

If you're looking for a reliable and comprehensive personal finance software to help you take control of your finances, look no further than Quicken Classic Deluxe. With its user-friendly interface and robust features, this software is perfect for individuals and families seeking to manage their finances effectively.

Beginners Tip: When buying similar products, make sure to look for software that connects to multiple financial accounts, including banking, credit cards, debt, investments, and property. This will give you a clear picture of your financial situation.

- Avoid software that is overly complicated or difficult to navigate. You want a software that is easy to use and understand.

- Make sure the software provides tools to manage and grow your savings, including budgeting, tracking spending, and setting financial goals.

Quicken Classic Deluxe is a comprehensive software that provides a clear picture of your financial situation, helping you make informed decisions about your money. With its user-friendly interface and robust features, this software is well worth considering for anyone seeking to achieve financial stability and security.

- In conclusion, Quicken Classic Deluxe is a valuable tool for anyone looking to take control of their finances. Its numerous benefits and features make it a must-have for anyone seeking to achieve financial stability and security.

Mastering Your Finances: Common Questions Answered

-

Q: Is Quicken Classic Deluxe compatible with my Mac or Windows device?

A: Yes, Quicken Classic Deluxe is compatible with both Windows and Mac devices, allowing you to manage your finances seamlessly across multiple platforms.

-

Q: Can I connect multiple financial accounts to Quicken Classic Deluxe?

A: Yes, Quicken Classic Deluxe allows you to connect multiple financial accounts, including banking, credit cards, debt, investments, and property, giving you a comprehensive view of your financial situation.

-

Q: How do I create a custom budget with Quicken Classic Deluxe?

A: Creating a custom budget with Quicken Classic Deluxe is easy. Simply set your financial goals, allocate your income, and track your expenses to stay on top of your finances.

-

Q: Can I project different debt scenarios with Quicken Classic Deluxe?

A: Yes, Quicken Classic Deluxe allows you to project different debt scenarios, helping you make informed decisions about managing your debt and achieving financial freedom.

-

Q: Are there any limitations to Quicken Classic Deluxe's reporting capabilities?

A: While Quicken Classic Deluxe provides robust reporting capabilities, some users may find the reporting options limited compared to other financial software.

-

Q: Is Quicken Classic Deluxe suitable for beginners?

A: Yes, Quicken Classic Deluxe is designed to be user-friendly, making it easy for beginners to get started and start achieving their financial goals.