Mastering Tax Planning for Retirement Savings: 15 Essential Strategies

Key Takeaways

- Learn 15 effective strategies for tax savings.

- Understand the importance of tax planning in retirement.

- Gain insights from a seasoned tax professional.

- Optimize your retirement savings with practical advice.

- Explore additional resources in Budgeting Tools and Debt Management.

As we approach retirement, effective tax planning becomes crucial for preserving our hard-earned savings. The book Tax Planning for Retirement Savings by James Blase CPA, JD, LLM offers invaluable insights into strategies that can significantly reduce your tax burden. This comprehensive guide breaks down 15 essential strategies tailored for individuals looking to optimize their retirement savings while minimizing both income and estate taxes.

About Tax Planning for Retirement Savings

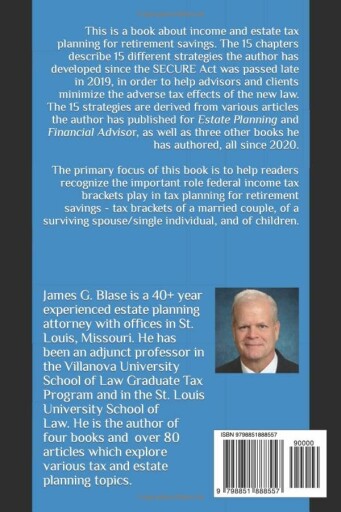

is a pivotal resource for anyone nearing retirement. Authored by tax expert James Blase, CPA, JD, LLM, this book meticulously covers 15 strategies that can help individuals save on both income and estate taxes. The book is designed to empower readers with the knowledge and tools needed to make informed decisions regarding their retirement savings.

Key Features

- Comprehensive Strategies: Offers 15 actionable strategies that cover various aspects of tax planning.

- Expert Insights: Written by a knowledgeable tax professional with years of experience in retirement planning.

- User-Friendly Format: The book is structured in a way that makes complex tax concepts accessible to all readers.

- Practical Examples: Includes real-life scenarios that illustrate how to apply the strategies effectively.

- Additional Resources: Provides links to further reading materials for enhanced understanding.

Ease of Use

This book is tailored for both beginners and seasoned investors. The straightforward language and well-organized chapters make it easy to navigate through the content. Each chapter concludes with a summary of key points, ensuring that readers can easily recall essential information.

Ideal Use Cases

Tax Planning for Retirement Savings is ideal for:

- Individuals approaching retirement who want to maximize their savings.

- Those looking to minimize their tax obligations in the years leading up to retirement.

- Professionals seeking a deeper understanding of tax implications on retirement savings.

- Anyone interested in estate planning and wealth preservation strategies.

For more resources related to saving and investing, consider exploring our sections on Investment Strategies and Saving for Retirement.

Check Current PriceBenefits and Drawbacks of Tax Planning for Retirement Savings

Pros

- Offers 15 actionable strategies that are easy to understand and implement.

- Written by a seasoned tax professional, providing expert insights.

- User-friendly format makes complex tax concepts accessible to everyone.

- Includes practical examples to illustrate application of strategies.

- Supports readers in maximizing retirement savings while minimizing tax burdens.

Cons

- Some strategies may require further research to fully understand.

- Focused primarily on U.S. tax laws, which may not apply to all readers.

- Complexity may be overwhelming for complete beginners.

Overall, provides a comprehensive guide with numerous advantages for individuals looking to optimize their retirement savings. While there are a few challenges, the benefits far outweigh the drawbacks, making it a valuable resource for effective tax planning.

Wrapping Up Your Tax Planning Journey

When considering , it’s essential to evaluate its benefits and drawbacks. This book offers a wealth of information with 15 actionable strategies that can help you minimize your tax burden and maximize your retirement savings. However, it may present challenges for those unfamiliar with U.S. tax laws or financial terminology.

Tips for Buyers

- Look for user-friendly resources: Ensure the book breaks down complex concepts into easily digestible information.

- Consider your financial background: Some strategies may require prior knowledge of tax planning.

- Avoid common mistakes: Don't skip examples; they often provide crucial context for understanding strategies.

- Research U.S. tax laws: Familiarize yourself with relevant laws to better apply the strategies provided.

In summary, by James Blase is a comprehensive guide that equips readers with essential strategies for effective tax planning. While some concepts may be challenging to grasp initially, the benefits of improved tax strategies can lead to significant savings in the long run.

For anyone serious about optimizing their retirement savings, this book is a highly recommended resource. With expert insights and practical advice, you’ll be well on your way to a financially secure retirement.

Check Current PriceYour Questions Answered: Tax Planning Insights

-

Q: Can I really improve my withdraw strategy by using this book?

A: Yes, many readers have found that the strategies outlined can significantly enhance their withdrawal tactics, leading to better financial outcomes.

-

Q: Is the content easy to understand for a beginner?

A: Absolutely! The book is designed with a user-friendly format, making complex concepts accessible even for those new to tax planning.

-

Q: Are the strategies tailored for U.S. tax laws?

A: Yes, the strategies primarily focus on U.S. tax laws, which may limit their applicability for readers outside the U.S.

-

Q: Does the book provide practical examples of the strategies?

A: Yes, it includes real-life scenarios that demonstrate how to effectively implement the strategies discussed.

-

Q: Will I need to conduct further research after reading?

A: While the book provides a solid foundation, some strategies may require additional research to fully grasp their implications.