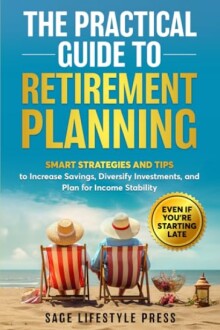

The Practical Guide to Retirement Planning: Smart Strategies for Financial Stability

Key Takeaways

- This guide provides practical strategies and tips for increasing savings, diversifying investments, and planning for income stability.

- Learn how to create a personalized plan tailored to your financial goals and needs.

- Discover how to make the most of your retirement savings and live the life you've always wanted.

As the sun sets on our working years, it's natural to wonder about the future of our finances. Will we be able to enjoy the retirement we've always dreamed of, or will we be stuck worrying about how to make ends meet? The truth is, planning for retirement is a daunting task, but with the right guidance, it doesn't have to be.

About The Practical Guide to Retirement Planning

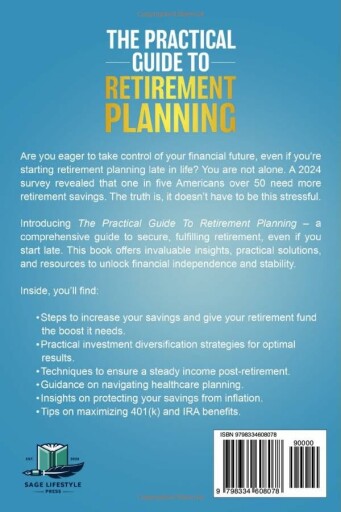

"The Practical Guide to Retirement Planning" is an essential resource for anyone looking to secure their financial future. Published on July 31, 2024, this book is designed to equip readers with smart strategies and actionable tips to increase savings, diversify investments, and plan for income stability—even if they are starting late in their financial journey.

Key Features

- Comprehensive Strategies: The book covers a variety of strategies tailored to different financial situations, ensuring that readers can find relevant advice no matter where they are in their retirement planning.

- Easy to Understand: Written in clear, straightforward language, this guide makes complex financial topics accessible to everyone, from beginners to experienced investors.

- Real-Life Examples: The author includes relatable case studies that illustrate how various strategies can be applied in real-life scenarios, providing readers with a practical understanding of each concept.

- Actionable Tips: Each chapter concludes with actionable steps that readers can take to implement the knowledge they've gained, encouraging proactive financial planning.

Design and Build Quality

The book is presented in a paperback format, making it both portable and durable for readers who wish to highlight key sections or jot down notes. The layout is thoughtfully designed, with clear headings, bullet points, and tables that facilitate easy navigation of the content.

Ease of Use

Readers will appreciate the user-friendly approach taken in this guide. The book is structured in a way that allows individuals to easily follow along and reference specific sections as needed. Whether you're reading it cover-to-cover or using it as a resource for particular topics, the organization enhances usability.

Who Can Benefit?

This guide is ideal for:

- Individuals just starting their retirement planning journey

- Those who feel overwhelmed by financial jargon

- Anyone looking to revisit or refine their existing retirement strategies

- Professionals seeking to diversify their investment portfolios

By addressing the diverse needs of various demographics, the book serves as a valuable tool in enhancing financial literacy and preparedness.

Use Cases

Here are some scenarios where this book can provide the most value:

- Planning for retirement in your 30s or 40s

- Seeking guidance on investment diversification

- Understanding the nuances of different retirement accounts

- Looking for ways to maximize savings before retirement

With its combination of practical advice, easy-to-understand language, and comprehensive strategies, "The Practical Guide to Retirement Planning" is a must-have for anyone serious about securing their financial future.

Check Current PriceEvaluating the strengths and weaknesses

Pros

- Comprehensive coverage of retirement strategies tailored for various financial situations.

- Written in clear, straightforward language, making it accessible for readers of all backgrounds.

- Includes real-life examples and case studies to enhance understanding of complex concepts.

- Provides actionable tips at the end of each chapter to encourage proactive planning.

- Designed with a user-friendly layout that facilitates easy navigation and reference.

Cons

- Some readers may find it too basic if they are already experienced in financial planning.

- The paperback format may not appeal to those who prefer digital or audiobook versions.

- Limited advanced strategies for seasoned investors looking for niche financial advice.

Overall, "The Practical Guide to Retirement Planning" emerges as a valuable resource, offering a wealth of practical strategies and insights while maintaining an easy-to-read format. The pros significantly outweigh the cons, making it a recommended choice for anyone looking to secure their financial future.

Final Thoughts on Your Path to Retirement Success

When considering "The Practical Guide to Retirement Planning," potential buyers should look for comprehensive coverage, clarity in explanations, and actionable advice. Common mistakes often include overlooking personalized strategies or sticking to outdated financial wisdom. This book stands out by addressing these concerns with a fresh perspective.

Benefits and Drawbacks Summary

- Benefits:

- Comprehensive strategies suitable for diverse financial situations.

- Clear and accessible language for readers at any experience level.

- Real-life examples that enhance understanding.

- Actionable steps to implement strategies effectively.

- Drawbacks:

- May be too basic for seasoned investors.

- Limited digital format options.

In conclusion, "The Practical Guide to Retirement Planning" is an invaluable resource for anyone looking to enhance their retirement planning strategies. Its strengths significantly outweigh the drawbacks, making it a must-have for individuals at any stage of their financial journey. With its actionable insights and user-friendly approach, this book can empower you to take control of your financial future and achieve the retirement you've always envisioned.

Check Current PriceYour Retirement Planning Queries Answered

-

Q: Is this book suitable for beginners?

A: Absolutely! The guide is designed as a **beginner's resource**, making complex financial concepts **easy to understand**.

-

Q: Does it cover investment diversification?

A: Yes, it includes strategies for **diversifying investments**, providing readers with actionable tips on how to achieve it.

-

Q: Can I use this book if I'm starting late in my retirement planning?

A: Definitely! The book emphasizes that it's never too late to **reassess and fine-tune** your retirement strategy.

-

Q: Are there real-life examples included?

A: Yes, the author shares relatable case studies that illustrate various strategies, making the content more **applicable**.

-

Q: What if I already have some experience in financial planning?

A: While the book is beginner-friendly, it still offers **valuable insights** that even seasoned planners might find useful for refreshing their strategies.